Centerra South plans unveiled; grocery included

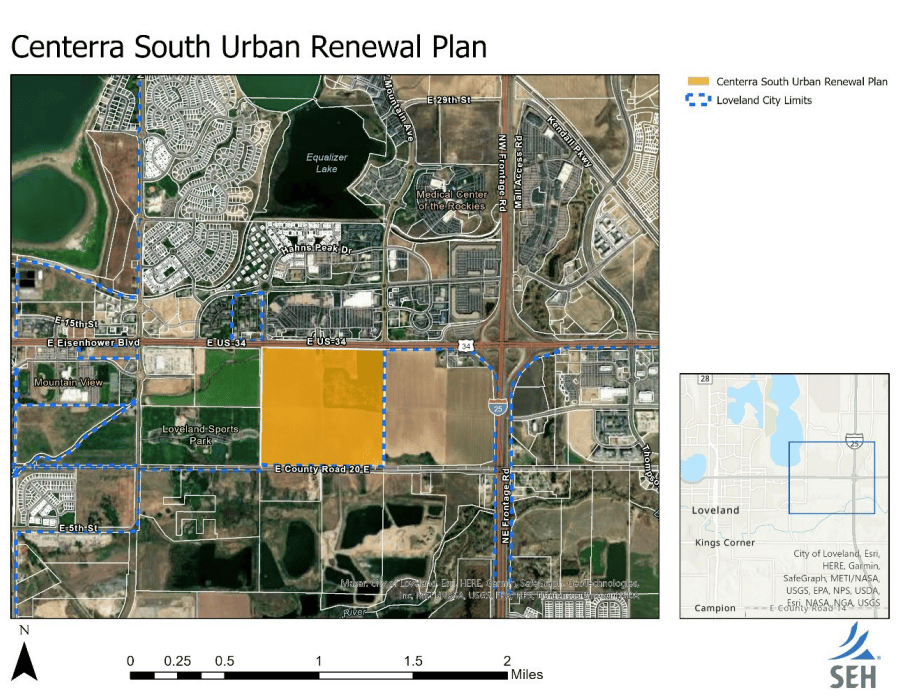

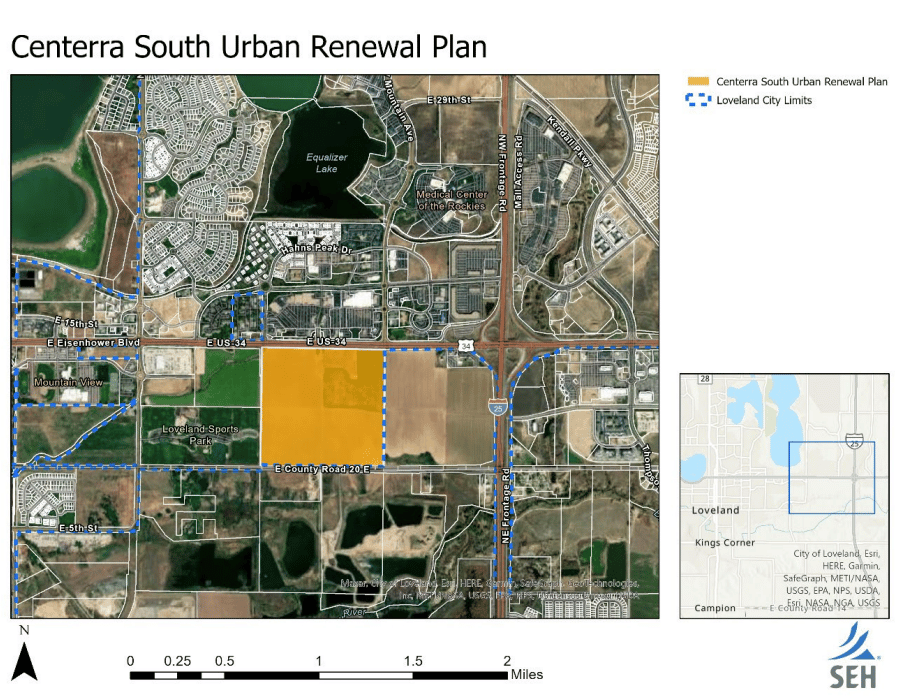

LOVELAND — McWhinney Real Estate Services Inc. will give the Loveland City Council its first official look Tuesday at what is now called Centerra South, a 148-acre development south of U.S. 34 across from the existing Marketplace at Centerra where a brick farmhouse and traditional barn now stand.

The tease: The development company will show in its preliminary development plan a grocery store — the single-most-requested retail element for people who live in the eastern part of the city.

The plan calls for a 40,000 square-foot grocery in the northeast corner of the development. Identity of the store is not defined in the proposal. The anticipated size is smaller than some others in the area. The King Soopers store at 1275 Eagle Drive is 66,000 square feet, according to the Larimer County Assessor. Whole Foods at 2201 S. College in Fort Collins is 71,000 square feet.

Opening date for a grocery store is speculative because the plan has yet to be approved, but the proposal before the city suggests that tax revenue from the store would materialize in 2028. The store was described as a “catalyst development” in the project.

Also included in Centerra South, which sometimes is called the McDonough development after the farm family that at one time owned and worked the land, are 298,083 square feet of commercial development (including the grocery) and 1,075 housing units, most of which will be in multifamily and duplex units. Only 103 single family and 27 townhomes are planned for the site.

The development, however, based upon information provided to the City Council, requires certain governmental actions, and it asks that the actions occur by April 1, a date tied to potential agreements with specific retailers.

First, the property needs to be declared blighted in order to qualify for urban renewal. McWhinney’s consultant said it meets five of 11 criteria for being blighted, with four necessary to qualify.

Second, the developer is asking that the 148-acre site be removed from the U.S. 34/Crossroads Corridor Urban Renewal Plan and that a new urban renewal area be created.

Third, the developer requests changes to the master finance agreement that has helped to finance much of the existing Centerra infrastructure and a new master finance agreement created for the new development that includes designating 1.25 percentage points of the city’s 3% sales tax for the project. This is similar to what exists in other parts of Centerra.

And finally, the proposal requests creation of new metro districts — one commercial and two residential metro districts — to govern the area.

The removal of the property from the existing URA and creation of a new MFA stems from the sunset dates of Centerra’s existing financial structures. The original Centerra financing mechanisms expire in 2029, which will be before Centerra South is completed.

Since the approval of the original Centerra URA and MFA, state law has changed. While the city council will still drive the process, other taxing entities must be consulted, and those entities will have a seat on a newly structured URA. A URA board is typically the city council; new URA boards give the county, the school district and special districts seats on the panel.

The council will meet in study session on Tuesday to hear the proposal, so no votes are anticipated, nor will public comment be taken because the council’s new rules on public comment have not yet taken effect.

The council will see and hear about a report from engineering firm SEH, also known as Short Elliott Hendrickson Inc., that the property meets the state’s requirements to be declared blighted. It has deteriorating structures, inadequate street layouts, unsafe conditions, inadequate public improvements or utilities, and “the existence of health, safety or welfare factors requiring high levels of municipal services,” according to the report.

Its access off U.S. Highway 34 is inadequate, with just one driveway, and its south access crosses the Great Western Railway at grade. Because the property has been used as a farm for generations, it has no streets, sewers or utilities.

The northern part of the development would be largely commercial. The southern part would be residential, with 722 multifamily units, 223 duplex units, 103 single-family homes and 27 townhomes, according to the plan. An estimated 2,520 new residents would locate there.

The plan anticipates use of tax-increment financing to pay for infrastructure. TIF plans take increased tax revenues — the difference between taxes collected now and what would be collected with new development — and use that money to repay bonds employed to finance the infrastructure.

Assessed value of the property is $3.8 million. Anticipated assessed value of the improvements was projected to be $69.1 million, according to the proposal. Property TIF revenue over 25 years was projected at $119.8 million and sales tax TIF revenue over the same period was projected at $81.7 million.

“The benefits outweigh the costs,” SEH concluded in its analysis.

Source: BizWest