Mixed results for Boulder area commercial real estate

BOULDER — The outbreak of COVID-19 was nearly three years ago, but the Boulder-area commercial real estate market is still digesting some of its lingering impacts.

That’s especially true in the office subsector, Becky Gamble, CEO of the brokerage Dean Callan & Co., told BizWest. Office buildings in certain Boulder County markets — notably, downtown Boulder — are experiencing historic vacancy rates with no owners facing obvious mechanisms to reverse the trend.

“It’s a period of uncharted waters,” Gamble said. “… The combination of COVID and tech [that has enabled working from home] has resulted in the demand for office [space] to greatly diminish, and it’s just not reenergized itself.”

Dean Callan just released its Boulder market report for the fourth quarter of 2022, which provides some insight into the strengths and challenges facing the commercial real estate industry during a time of uncertainty.

There are about 3,610,500 vacant square feet of office space in Boulder County, the report found, good for a vacancy rate of 34%.

The vacancy rate for offices in the downtown Boulder area is even higher at about 35%, Gamble said.

“That’s a really big number that downtown hasn’t experienced in decades,” she said, but added that “office [vacancy] isn’t just a Boulder issue or a downtown issue. It’s all across the country.”

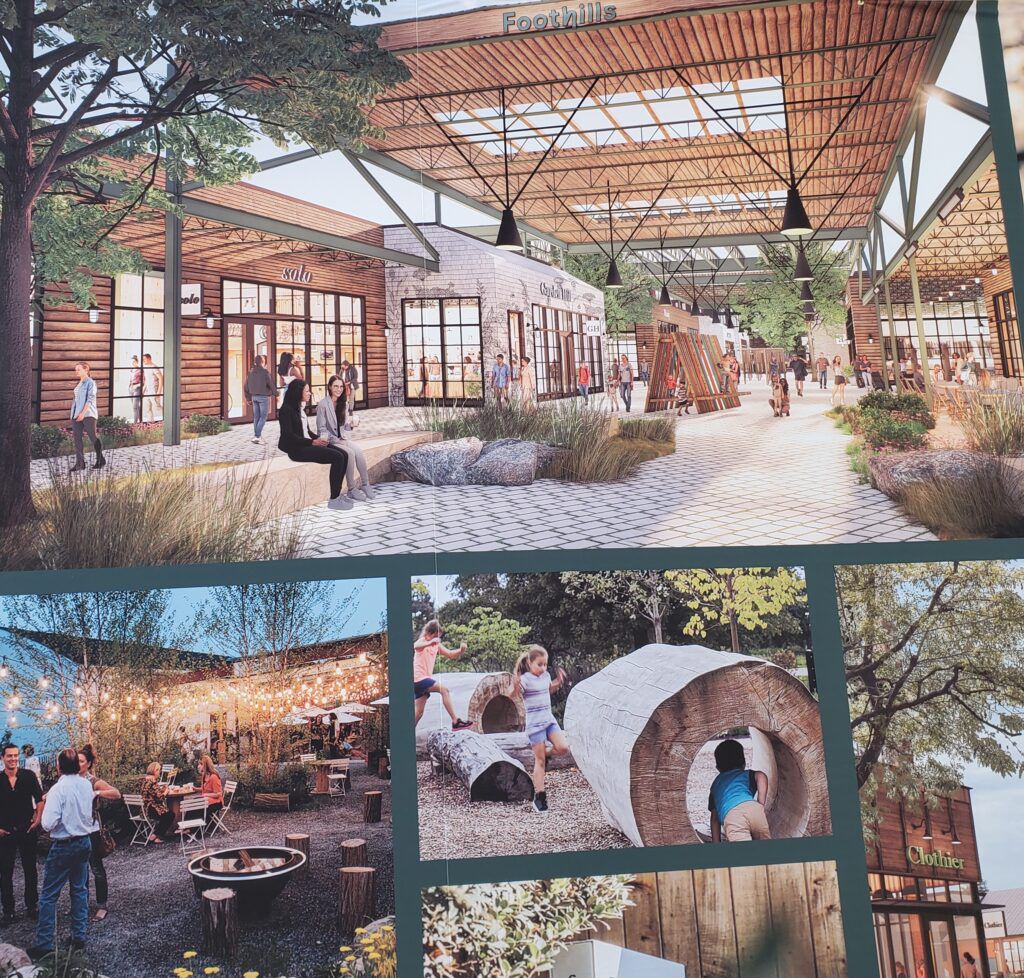

A bright spot for commercial real estate that might strike some observers as surprising is the retail sector.

“After COVID, people said, ‘We want to go into stores and touch objects,’” Gamble said.

Brick-and-mortar locations can also serve as status symbols for some brands.

“It’s not necessarily that stores are crushing it with their sales volume, but there’s intangible value for companies to have a retail presence,” Gamble said, especially in high-profile districts such as Boulder’s Pearl Street Mall.

Industrial properties, especially those with flex-office or lab space, performed well in late 2022 and continue to shine in 2023.

Life-science and biotechnology companies are major drivers of flex space demand. As spec buildings that have spent the past few years in the development process come on line, the region’s reputation as a biotech hub will likely grow.

“Time to market is always such a big thing for life-science users. Now that we actually have product that’s completed or close to being completed, [the region] will continue to open the door for companies considering their options for relocation and growth,” Gamble said.

There was an industrial vacancy rate of 5% to close out 2022, according to the Dean Callan & Co. report.

While the overall economic picture is murky to start the new year, Gamble said she doesn’t think any potential slowdown will be led by the real estate market.

The current situation is “definitely not” a replay of the Great Recession, she said. “Banks’ balance sheets are way better, real estate investors’ balance sheets are way better. Hopefully after 2008, everybody got a little smarter.”

Source: BizWest